26

Ethereum Blockchain Explained: What It Is, How It Works & Why It Matters

When people talk about Ethereum blockchain is a decentralized, open‑source ledger that records transactions and runs the Ethereum network, they’re describing a system that sits at the heart of a massive ecosystem of apps, finance tools, and digital assets.

Understanding the Ethereum blockchain helps you see why it’s reshaping finance, gaming, and even supply‑chain tracking.

Core Concepts Behind Ethereum

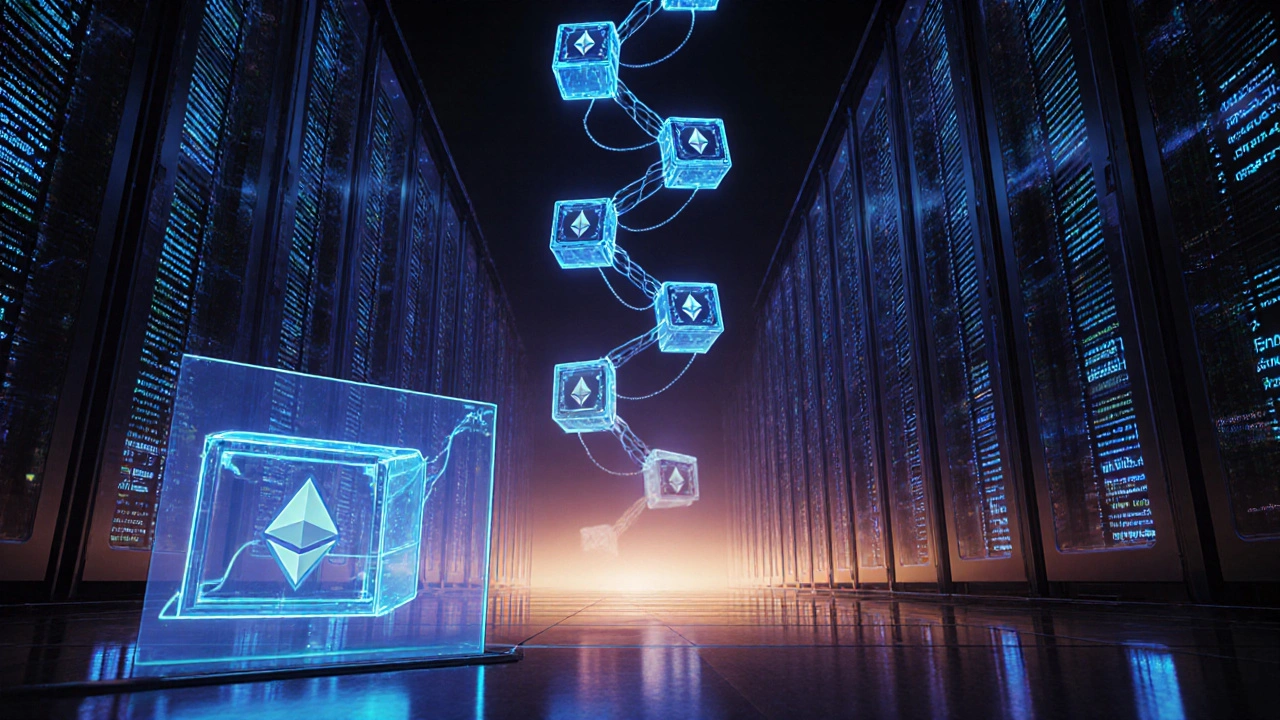

At its simplest, a blockchain is a series of linked blocks that store transaction data in a way that’s hard to tamper with. Each block contains a batch of transactions, a timestamp, and a cryptographic hash that points to the previous block, creating an immutable chain.

Ethereum is a programmable blockchain platform launched in 2015 by Vitalik Buterin and a team of developers. Unlike Bitcoin, which mainly tracks value transfers, Ethereum lets developers write code that runs automatically when certain conditions are met.

The native cryptocurrency of the network is called Ether (symbol ETH). Ether fuels transactions, pays for computation, and serves as a store of value.

How Ethereum Works: Consensus and Transactions

Ethereum originally used a Proof‑of‑Work (PoW) algorithm, similar to Bitcoin’s mining process. In September 2022, the network transitioned to Proof of Stake (PoS), where validators lock up Ether as collateral and are randomly chosen to propose and attest to new blocks.

When you send a transaction, you specify the amount of Ether, the recipient address, and a gas limit. gas is a unit that measures how much computational work a transaction requires. Validators deduct the gas fee from your balance and include the transaction in the next block.

The shift to PoS brought three major benefits: lower energy consumption (by more than 99%), faster finality (transactions confirm in about 12seconds), and a path toward scaling solutions like sharding.

Smart Contracts and Decentralized Applications (dApps)

A smart contract is self‑executing code stored on the blockchain that runs when predetermined conditions are met. Smart contracts are written primarily in Solidity, a language that compiles to bytecode understood by the Ethereum Virtual Machine (EVM), the runtime environment that executes contract code across all nodes.

Developers combine multiple smart contracts to build decentralized applications (dApps). A dApp might be a DeFi lending platform, an NFT marketplace, or a blockchain game. Because the code lives on the Ethereum blockchain, users don’t need to trust a single company; the network enforces the rules.

DeFi-short for decentralized finance is a set of financial services like lending, borrowing, and trading that run on smart contracts without intermediaries-has exploded. In early 2025, total value locked in Ethereum‑based DeFi protocols exceeded $45billion, illustrating how much real money now depends on these contracts.

Ethereum vs. Bitcoin: Key Differences at a Glance

| Feature | Ethereum | Bitcoin |

|---|---|---|

| Launch Year | 2015 | 2009 |

| Consensus | Proof of Stake (PoS) | Proof of Work (PoW) |

| Native Currency | Ether (ETH) | Bitcoin (BTC) |

| Transaction Speed | ~12‑15seconds per block | ~10‑12minutes per block |

| Smart Contract Support | Yes (EVM) | No |

| Primary Use‑Case | Programmable platform for dApps | Digital gold / store of value |

The table shows why developers gravitate toward Ethereum: its ability to run code gives it flexibility that Bitcoin simply can’t match.

Real‑World Uses and Growing Ecosystem

From supply‑chain tracking to identity verification, Ethereum’s open standards enable countless applications. Companies like IBM and Maersk use Ethereum‑based solutions to certify the provenance of goods, cutting paperwork and fraud.

In the gaming world, titles such as Axie Infinity and Gods Unchained let players truly own in‑game assets as NFTs, which can be traded on secondary markets for real money.

Even governments are experimenting. The European Union’s “EuroChain” pilot uses Ethereum to issue carbon‑credit tokens, aiming for transparent emissions trading.

These examples illustrate a key point: the Ethereum blockchain isn’t just a cryptocurrency platform; it’s a foundation for programmable, trust‑less interactions across industries.

Getting Started: Wallets, Gas, and Safety Tips

1. Choose a wallet: MetaMask, Trust Wallet, and hardware options like Ledger are the most popular. A wallet stores your private keys, not your Ether, so keep the seed phrase safe.

2. Buy some ETH: Use reputable exchanges (Coinbase, Kraken, or Gemini) to purchase Ether, then transfer it to your personal wallet.

3. Understand gas fees: On busy days, gas can spike above $100 for complex transactions. Use tools like Etherscan Gas Tracker to pick low‑traffic windows.

4. Interact with dApps carefully: Always verify the contract address on the official site. Scammers often copy UI screens to steal funds.

5. Stay updated: Ethereum’s roadmap includes “sharding” in 2025, which will increase throughput dramatically. Follow the Ethereum Foundation blog for the latest upgrades.

Common Misconceptions About Ethereum

Myth 1: Ethereum is just a copy of Bitcoin. While both are blockchains, Ethereum’s programmable nature makes it a platform for building applications, not merely a store of value.

Myth 2: Ethereum is too slow for real‑world use. After the PoS upgrade, average transaction confirmation is under a minute, and Layer‑2 solutions like Arbitrum and Optimism push fees down to pennies.

Myth 3: All Ether is volatile and risky. Ether’s price does fluctuate, but its utility as “gas” gives it an intrinsic demand that's separate from speculative trading.

Frequently Asked Questions

What exactly is the Ethereum blockchain?

The Ethereum blockchain is a decentralized ledger that records transactions and runs smart contracts. It provides a global computer where anyone can deploy code that executes exactly as written without a central authority.

How does Ethereum differ from Bitcoin?

Bitcoin is primarily a digital cash system, whereas Ethereum is a programmable platform. Ethereum supports smart contracts, faster block times, and after the "Merge" runs on Proof of Stake, which Bitcoin still uses Proof of Work.

What is gas and why does it cost money?

Gas measures the computational effort required to execute operations on the Ethereum network. Users pay gas fees in Ether to compensate validators for the resources they spend processing transactions.

Can I store my Ether on an exchange?

Yes, but it’s safer to move it to a personal wallet where you control the private keys. Exchanges hold the keys for you, which introduces custodial risk.

What are Layer‑2 solutions?

Layer‑2s are secondary protocols (like Optimism, Arbitrum, and zkSync) that process transactions off‑chain and then settle them on Ethereum. They dramatically reduce gas costs and increase throughput.

Is Ethereum environmentally friendly?

Since the switch to Proof of Stake in 2022, Ethereum’s energy usage dropped by over 99%, making it comparable to the power consumption of a midsize data center.