19

Tax and Fees on Streaming Services: What’s Included in Your Bill

Ever looked at your streaming bill and wondered where all the extra money went? You signed up for Netflix, Disney+, and Apple TV+, expecting a clean monthly charge. But then you see it: $12.99 for Netflix, $15.99 for Disney+, $11.99 for Apple TV+, and suddenly your total is $45.73. Where did the extra $14.76 come from? It’s not just the subscriptions. It’s taxes, fees, and mandatory surcharges-most of which you didn’t sign up for, but you’re still paying for.

What You’re Really Paying For

Streaming services don’t just charge you for content. They add layers of costs that vary by country, state, and even your internet provider. In Australia, where I live in Brisbane, your bill might include:

- Goods and Services Tax (GST) - 10% on most digital services

- State-based broadcasting levies - Some states charge small fees for content distribution

- Payment processing fees - Charged by your bank or credit card provider

- Content licensing surcharges - Hidden in fine print, these cover rights to local shows or sports

For example, if you pay $15.99 for Disney+, the actual price before tax might be $14.54. The rest? That’s GST. It’s not optional. It’s legally required. But most people assume the price they see is the price they pay. It’s not.

Why Different Services Charge Different Fees

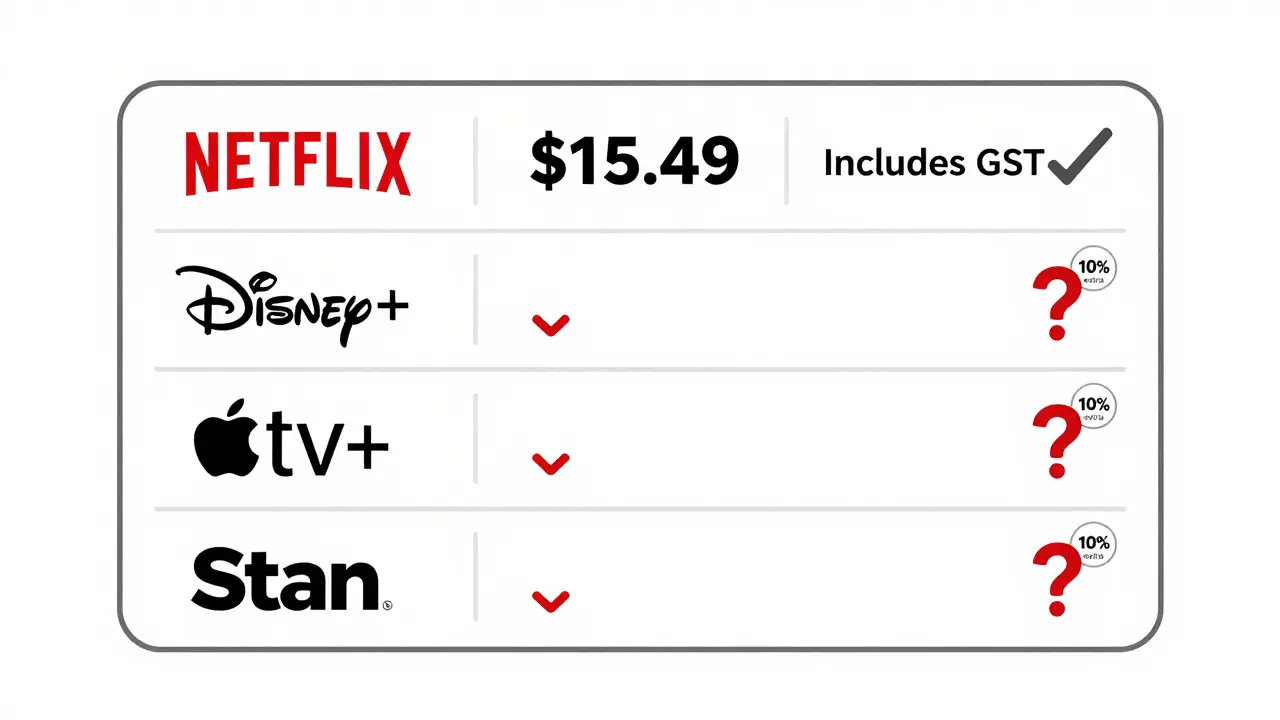

Not all streaming platforms are created equal when it comes to fees. Netflix, for instance, includes GST in its displayed price in Australia. So you see $15.49 - that’s the full amount. No surprises. But Apple TV+? They show the pre-tax price. Then they tack on GST at checkout. Same for Amazon Prime Video. It’s inconsistent.

Here’s how it breaks down across major services in Australia as of 2026:

| Service | Monthly Price (AUD) | Includes GST? | Additional Fees |

|---|---|---|---|

| Netflix | $15.49 | Yes | None |

| Disney+ | $15.99 | No | None |

| Apple TV+ | $11.99 | No | None |

| Amazon Prime Video | $14.99 | No | Occasional regional surcharge |

| Stan | $12.99 | Yes | None |

| Foxtel Now | $25.00 | Yes | Channel pack add-ons |

Stan and Netflix are the most transparent. They show you the total. Disney+ and Apple TV+ make you do the math. And Foxtel Now? It’s a maze of add-ons. Want the sports pack? That’s another $15. Want the drama bundle? Another $10. These aren’t taxes - they’re upsells disguised as necessary features.

How Taxes Are Calculated

It’s not as simple as “10% GST.” The Australian Taxation Office (ATO) treats digital services like physical goods. That means if a service is delivered electronically and consumed in Australia, GST applies. But here’s the catch: it’s the service provider who collects and remits the tax, not you.

So if you’re using a US-based service like Hulu or Max, and you’re in Australia, they’re still required to charge you GST - even if they’re based overseas. That’s because Australia has a reverse charge mechanism for digital products. It’s not a loophole. It’s law.

Some services don’t even bother. They block Australian users. Others just add GST quietly. You won’t see it listed separately on your receipt. You’ll just see a higher total. And that’s legal - as long as they’re collecting it.

Hidden Fees You Can’t Avoid

Then there are the fees that aren’t taxes at all - but feel like they should be.

Some services charge what they call a “content licensing fee” - a vague term that usually means they paid extra for the rights to show a local Australian show or sports event. It’s not a government fee. It’s their cost, passed on to you. You’ll find it buried in the terms of service. No one explains it. No one has to.

Another sneaky one: payment processing fees. If you use a credit card that charges international transaction fees, you might be paying an extra 2-3% per month. That’s $0.30 to $0.50 extra per service. Multiply that by four services? That’s $1.20 to $2.00 extra every month. And you didn’t even know it was happening.

Even your internet provider can play a role. Some ISPs in Australia bundle streaming services into their plans. You pay $80 for internet and get Netflix included. Sounds great - until you realize you’re locked in for 24 months, and your internet rate goes up 15% after 12 months. The “free” streaming service isn’t free anymore.

What You Can Do About It

You can’t stop GST. But you can stop overpaying.

- Check your bank statements - Look for recurring charges labeled “Digital Content,” “Streaming,” or “Online Service.” If you see a charge you don’t recognize, cancel it.

- Use direct debit or PayPal - Avoid credit cards with foreign transaction fees. PayPal doesn’t charge extra for Australian users.

- Compare total prices - Don’t just look at the headline price. Add GST manually. If Disney+ says $15.99, calculate $15.99 × 1.10 = $17.59. That’s what you’re really paying.

- Cancel unused services - If you haven’t watched something in 30 days, cancel it. You can always restart. Most services let you rejoin without penalty.

- Ask for receipts - If you’re being charged extra and the service doesn’t itemize it, contact support. Demand a breakdown. If they refuse, switch providers.

There’s no law that says streaming services have to be transparent. But there’s also no law that says you have to accept it.

Why This Matters

Streaming isn’t just entertainment. It’s a financial commitment. And if you’re not tracking the full cost - including taxes, fees, and hidden add-ons - you’re leaving money on the table. The average Australian household now spends over $80 a month on streaming services. That’s $960 a year. And nearly $100 of that? It’s in fees and taxes you didn’t know were there.

It’s not about being cheap. It’s about being informed. You’re paying for content. You’re not paying for bureaucracy. If a service hides the cost, it’s not being honest. And you don’t have to stick with them.

Next time you see your bill, pause. Look at the numbers. Ask: What am I really paying for? The answer might surprise you - and save you money.

Do all streaming services in Australia charge GST?

Yes, if they’re registered with the ATO to sell digital services in Australia. Most major services like Netflix, Disney+, Apple TV+, and Stan are. Smaller or international services may not be - but if they’re accessible to Australians, they’re legally required to charge GST. If you don’t see GST on your bill, check if the service is based overseas and whether they’ve registered with the ATO. Some don’t, and that’s a red flag.

Can I avoid paying GST on streaming services?

No. GST is a tax on consumption, not on the service provider. If you’re in Australia and using a digital service, GST applies. Even if you use a VPN to appear as if you’re overseas, the ATO can still track your billing address and payment method. Trying to avoid it isn’t worth the risk - and it won’t work.

Why does Disney+ show a lower price than Netflix?

Disney+ shows the pre-tax price. Netflix shows the final price. It’s a marketing choice. Disney+ wants you to think it’s cheaper. But when you add 10% GST, Disney+ ends up costing more than Netflix. Always compare the final amount - not the headline number.

Are there any streaming services in Australia that don’t charge extra fees?

Yes. Stan and Netflix are the most straightforward. They show one price - no hidden add-ons, no regional surcharges, no payment fees. If you want simplicity, stick with them. Foxtel Now, Amazon Prime Video, and others often layer on extra costs. Check their pricing pages carefully before signing up.

Can I get a refund if I didn’t know about the extra fees?

Unlikely. Most services have terms that say you agree to all fees when you sign up. But if you were misled - for example, if a service advertised a price and then added a surprise fee without disclosure - you can complain to the ACCC (Australian Competition and Consumer Commission). They’ve taken action against companies for exactly this. Keep your receipts and screenshots.