Crypto Market Volatility: Understanding the Swings and What Drives Them

When tracking crypto market volatility, the rapid rise and fall of cryptocurrency prices that can occur within minutes or hours. Also known as crypto volatility, it shapes investment decisions and market sentiment. Crypto market volatility is a wild ride, but knowing what pushes it can turn chaos into opportunity. One of the core pillars you need to grasp is Ethereum, a leading blockchain that hosts many DeFi tokens and smart contracts, which often moves the market when upgrades or token launches generate buzz. Another piece of the puzzle is the hot wallet, an online crypto storage solution that lets users trade quickly but exposes them to price swings. Finally, smart contracts, self‑executing code on blockchains that automate transactions and trigger rapid buying or selling add a layer of algorithmic pressure on prices. Together, these entities form the backbone of today’s volatile crypto landscape.

Understanding the Drivers of Crypto Volatility

Market volatility doesn’t happen in a vacuum. News about regulations, security breaches, or macro‑economic shifts can cause sudden spikes or drops. For instance, a new policy from a major economy often triggers a chain reaction across exchanges, because traders react to perceived risk. Likewise, technical events on a blockchain—such as a hard fork on Ethereum—create uncertainty, prompting rapid re‑balancing of portfolios. Social media hype, influencer endorsements, and meme trends add another fast‑moving factor; a single tweet can ignite a buying frenzy, illustrating how sentiment fuels price swings. All these forces intersect, meaning that crypto market volatility is essentially a product of information flow, technology updates, and human emotion.

Because volatility is so tied to information, timing becomes crucial. Traders who monitor real‑time data feeds, on‑chain analytics, and news aggregators can anticipate short‑term moves. Meanwhile, long‑term investors watch fundamentals such as network activity, developer adoption, and token utility. Understanding whether a price swing is driven by genuine network growth or merely hype helps decide if a move is a buying opportunity or a temporary flash. In practice, this means blending technical analysis with a grasp of blockchain fundamentals—a skill set that bridges finance and technology.

Managing exposure to rapid price changes often starts with the right storage solution. A hot wallet gives you instant access to trade during volatile periods, but it also puts funds at higher risk if a platform is compromised. Conversely, a cold wallet, offline hardware that stores private keys away from the internet provides safety at the cost of slower reaction time. Many seasoned traders keep a small portion of assets in a hot wallet for quick moves, while the bulk stays in cold storage to protect against hacks. Choosing the right mix depends on your risk tolerance and how actively you plan to trade during volatile markets.

Smart contracts also play a direct role in volatility through automated market makers (AMMs) and decentralized finance (DeFi) protocols. When liquidity pools on platforms like Uniswap shift dramatically—often because large traders add or withdraw funds—prices can swing sharply without any external news. These on‑chain mechanisms mean that a single contract execution can ripple across multiple tokens, amplifying volatility. Understanding how AMMs calculate price curves and how impermanent loss works equips you to anticipate sudden shifts that arise from pure code execution.

Putting all these pieces together, you’ll see that crypto market volatility is not a random glitch but a predictable pattern driven by technology, sentiment, and risk management choices. Below you’ll find a curated set of articles that break down each component— from the basics of the Ethereum blockchain to practical tips on using a hot wallet. Dive in to sharpen your understanding, spot the next swing, and turn volatility into a strategic advantage.

5

What Causes a Crypto Market Crash? - Key Triggers Explained

Explore the main factors behind crypto market crashes, from macro‑economics and regulation to liquidity and sentiment, and learn how to spot warnings and protect your investments.

Latest Posts

Popular Posts

-

The Seventh Seal Explained: Ingmar Bergman’s Medieval Meditation on Death

The Seventh Seal Explained: Ingmar Bergman’s Medieval Meditation on Death

-

Villains in Action Cinema: Why Antagonists Define the Thrill

Villains in Action Cinema: Why Antagonists Define the Thrill

-

Which Streaming Service Has the Most 4K and HDR Titles in 2026?

Which Streaming Service Has the Most 4K and HDR Titles in 2026?

-

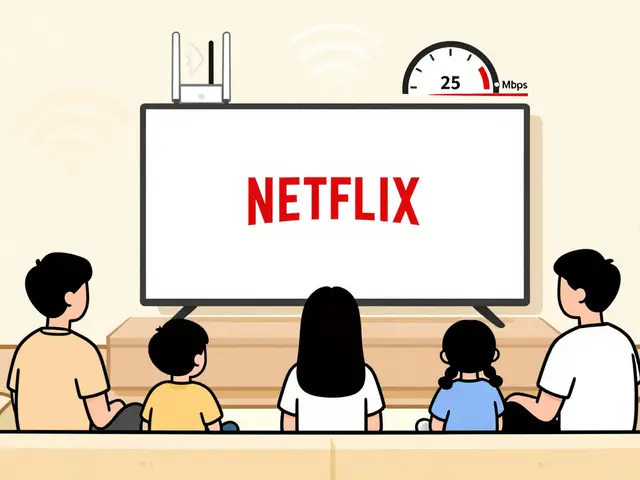

Netflix Recommended Internet Speeds: Official Requirements Explained

Netflix Recommended Internet Speeds: Official Requirements Explained

-

Latin American Streaming: Claro Video, Star+, and Local Services Explained

Latin American Streaming: Claro Video, Star+, and Local Services Explained

Categories

Tags

- streaming services

- video editing

- video production

- parental controls

- Max streaming

- video editing software

- marketing mix

- subscription management

- streaming apps

- video editing tips

- tips

- ROI

- video marketing

- video editing tools

- marketing strategy

- Premiere Pro

- family viewing

- classic cinema

- Kurosawa

- streaming setup